When you have Zong, you are part of the Zong network (also known as the Zong SMS network). Along with all the benefits of calling and messaging to any other mobile numbers across Pakistan or abroad, it comes with taxes on calls, SMS, and internet bundles, which customers pay through their bills every month. So, along with all your annual tax statement records, you’ll also require a Zong Tax certificate so that you can attach it to your income tax return and submit it to the FBR. In this article, we will tell you how to obtain your Zong Tax certificate from the company itself.

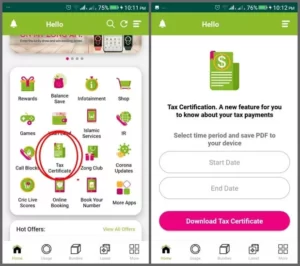

Get a Tax Certificate through Zong App

You can easily get your Zong tax certificate through the Zong app, follow the below steps:

- First of all, open your Zong App

- Enter your Zong number

- They will send a Pin code in a message.

- Enter this pin code in the given section and login

- Click on the Tax Certificate option which is shown on the home screen.

- Select the start and end date

- You will get the tax certificate in PDF form.

Get a Tax Certificate through Zong eCare:

You can also download a tax certificate through Zong e Care, Follow the below procedure to get your tax certificate:

- First open Zong e Care website

- Enter Zong SIM number

- Enter the character in 2nd box that is required

- Now click on the login to get access to your account

- Enter the given code that is sent by the Zong

- You will automatically be redirected to the Zong e Care web page.

- Click on option 5 which is usage history, they will not give some other options to you.

- Entre starts to end date to download your tax certificate.

Conclusion:

Visit Zong App and Zong e Care Portal to request a tax certificate. The process will not be complicated if you know what to do. Read through, and you’ll find that it is pretty straightforward and easy to understand; just follow instructions, fill out information accordingly and submit. You’ll get a certificate in no time!